WRH+Co employs a comprehensive understanding of the requirements of Regulation A+ Offerings. Frequently termed Regulation A+, this exemption under the Securities Act of 1933 permits companies to raise capital publicly from a wider range of investors compared to traditional IPOs. Utilizing its expertise in securities law and finance, WRH+Co guides clients through every stage of the Regulation A+ process, beginning with registration and culminating in. A successful Regulation A+ offering can provide a public company profile, increase market accessibility, and ultimately drive growth.

- Considering a Regulation A+ Offering?

- Contact WRH+Co today for a personalized consultation.

A Regulation A+ Offering: Fact or Fiction?

The capital markets landscape continues to transform rapidly, with new avenues for companies to raise funds. Regulation A+, a relatively recent amendment to securities laws, has drawn the eye of both startups and established businesses alike. Proponents hail it as a game-changer, promising to level the playing field. Opponents, however, warn against potential pitfalls and inflated expectations. So, is Regulation A+ truly the panacea it's made out to be, or just another example of hype in the world of finance?

- To delve into the intricacies of Regulation A+, its potential benefits and drawbacks, in order to assess whether it lives up to the buzz surrounding it.

Explain Title IV Regulation A+ for investors | Manhattan Street Capital

Title IV Regulation A+, sometimes referred to as Reg A+, is a rule that allows private companies to raise capital from the public. It offers a simplified process compared to traditional initial public offerings (IPOs). Under this system, companies can offer their securities to a larger range of investors, including both accredited and non-accredited individuals. Manhattan Street Capital is a leading platform that facilitates Reg A+ initiatives, providing companies with the resources to successfully complete their campaigns.

- Benefits of Regulation A+ include increased capital access for growth-stage companies and a more open fundraising process.

- MSC focuses in Reg A+ transactions, giving comprehensive support to companies throughout the entire stage.

If you are a company needing funding or an investor interested in participating in Reg A+ offerings, Manhattan Street Capital can be a valuable partner.

Businesses Embrace a New Reg A+ Solution

A wave of modernization is sweeping through the investment world, with businesses increasingly turning to Reg A+ as a efficient tool for raising capital. This legal framework offers an alternative for publicly traded companies to access capital from the wide market.

The growing trend of Reg A+ utilization is driven by its benefits, including increased exposure and cost-effectiveness. Enterprises are leveraging this framework to reach new markets.

- Advantages of Reg A+ range from

- Enhanced transparency and disclosure requirements

- Affordable compared to traditional investment methods

- Pooled access to a wider pool of resources

A Quick Look At Regs - We Got 'Em All

So you're wondering about the rules, huh? Well, let me tell you, we've got them all. Whether it's state laws or even some weird ones, chances are we have heard of it. Don't be afraid to ask! We're here to help you navigate the tricky world of regulations.

Want to find out a specific reg? Just ask away.

Embracing Regulation A+ in Startups

Regulation A+, a groundbreaking securities regulation, provides startups with a unique avenue to raise capital from the public. By offering shares, eligible companies can tap into a wider pool of funders. While this presents a significant advantage, startups must thoroughly understand the obligations associated with Regulation A+. Failure to do so can result in legal difficulties.

- Key among these elements is the need for a detailed business plan that articulates the company's growth prospects.

- Additionally, startups must conform with stringent reporting requirements to guarantee investor assurance.

- Finally, seeking assistance from experienced legal and financial professionals is essential to navigating the complexities of Regulation A+ successfully.

Reg A+ Works with Equity Crowdfunding

Regulation A+, also known as Reg A+, is a unique tool within the United States securities laws that enables companies to raise capital through a system called Direct listing equity crowdfunding. Under Regulation A+, companies can offer and sell their equity to the masses. It's a structured avenue for businesses to tap into a wider pool of investors. A key benefit of Regulation A+ is that it provides companies with the possibility to raise significant amounts of capital, up to a set limit, without requiring the same stringent standards as traditional initial public offerings (IPOs).

Furthermore, Regulation A+ offers investors a opportunity to invest in promising companies at an early stage, potentially achieving attractive returns. However, it's important for both companies and investors to understand the specifics of Regulation A+ before participating in this type of crowdfunding.

Regulation A+ Offering Fund Athena

FundAthena has recently launched a groundbreaking Offering/Investment Platform/ Fundraising Initiative under the Securities and Exchange Commission's (SEC) Regulation A+. This regulatory framework/provision/method permits public companies to raise capital from both accredited and non-accredited investors, unlocking new avenues for growth/expansion/development. FundAthena aims to leverage this unique opportunity/structure/mechanism to empower innovative businesses by connecting them with a diverse pool of investors/supporters/backers.

The company/platform/initiative is committed to transparency/accountability/openness throughout the process/journey/campaign. Investors will have access to detailed information/updates/reports regarding FundAthena's performance/progress/development, fostering a strong relationship built on trust/confidence/faith. With its strategic focus/clear vision/bold ambition, FundAthena is poised to become a leading force/driving factor/catalyst in the evolving landscape of finance/capital markets/investment strategies.

Shell Venture Securities

The recent surge in demand for blank-check companies , also known as SPACs , has attracted significant speculation. Colonial Stock Securities is one such entity that has gained traction in this evolving market . Their structure involves raising funds through an share sale and then using it to acquire an existing business . This method offers a expedited route to going traded compared to traditional IPOs.

- However, the uncertainties associated with blank-check companies are significant .

- Investors need to conduct due diligence before committing capital .

- The lack of a clear operating company at the outset can make it difficult to assess the true value of these investments.

Control

Regulation plays a crucial role in shaping the environment of industries. It involves the establishment of rules that direct the behavior of organizations. Effective governance aims to reduce risks, foster ethical practices, and provide a balanced marketplace within various sectors.

A Unique Individual Was Spotted

This place has been buzzing with excitement. We've finally stumbled upon a rare regular. Word on the block is that they are a real character. It seems this individual has been hanging around for some time, and now we're just learning about who they really might be. We'll keep you updated on all the juicy scoops as we unravel the mystery.

Unlocking Capital Through Title IV Reg A+

Dive into the fascinating world of crowdfunding platforms with our insightful infographic on Title IV Reg A+. This essential tool breaks down the intricacies of this powerful fundraising mechanism , empowering entrepreneurs to raise capital . Explore the perks of Title IV Reg A+, understand its influence on the financial landscape , and discover how it can be your pathway to growth .

- Learn the fundamental aspects of Title IV Reg A+.

- Gain insights of this groundbreaking approach .

- See the process involved in a successful Title IV Reg A+ fundraising effort.

Offering Regulation A+ - Securex Filings LLC

Securex Filings LLC is a top company specializing in managing funding through the Regulation A+ process. Our team has extensive knowledge in navigating the complexities of this regulatory system, helping companies effectively raise capital. Securex Filings LLC offers a comprehensive suite of services to simplify the Regulation A+ process, from initial planning to final disclosure.

Moreover, Securex Filings LLC stays at the forefront of regulatory trends, ensuring their companies benefit from the most current information. Their commitment to clarity and investor satisfaction establishes Securex Filings LLC as a valued partner in the Regulation A+ sector.

Explore Crowdfund.co

Crowdfund.co is a dynamic hub that connects backers with aspiring entrepreneurs seeking funding for their projects. Whether you're an user eager to contribute groundbreaking endeavors or an founder hoping to launch your dream, Crowdfund.co offers a diverse range of possibilities.

Through its user-friendly interface, Crowdfund.co streamlines the crowdfunding process, enabling it available to a broad audience. You can browse a curated selection of initiatives across different categories, from art to lifestyle.

Crowdfund.co offers valuable tools for both creators and supporters, including progress tracking, communication channels, and reward tiers.

Embark your crowdfunding journey with Crowdfund.co today and join of a growing community dedicated to championing innovation and social impact.

Reg A+ Offering by Fundrise

Fundrise is currently launching a new equity crowdfunding campaign to attract capital for its portfolio of properties. This offering gives retail investors the opportunity to purchase shares of Fundrise's strategic portfolio of income-producing real estate.

The company claims that the offering aims to expanding its existing portfolio and purchasing new properties. Fundrise has been successful in returns to fund participants in the past, which may contribute investor interest.

The Securities and Exchange Commission

The Securities and Exchange Commission is an independent agency of the U.S. government. It's primary function is to monitor the securities industry and safeguard investors. The SEC achieves this mission by implementing federal investment laws, offering market participants with reliable reports, and fostering fair and efficient trading.

- {The SEC's jurisdiction encompasses a broad range of investments, including shares, fixed income, investment funds, and derivatives.

- {The agency also regulates{ investment advisers, broker-dealers, and other market participants.

- {To ensure compliance with federal securities laws, the SEC performs audits, brings legal charges, and fines.

Capital Raising Title IV

CrowdExpert's Title IV framework facilitates businesses to raise capital through public investment. This innovative approach offers access to a wider pool of investors, transforming the funding landscape. By leveraging technology, CrowdExpert simplifies the process, making it highly convenient for both startups seeking funding and individuals looking to engage in the growth of promising projects.

Evaluating the Waters Crowdfunding for common people

Crowdfunding has exploded in popularity, allowing a new avenue for individuals to acquire funds for their projects. But prior to diving headfirst into a full-scale campaign, many are choosing to {test{ the waters with a smaller, limited crowdfunding effort. This allows them to gauge public interest and refinance their pitch before committing a larger campaign.

It's a smart move for both individuals and teams who are hesitant about the potential of their project.

Testing the waters with a smaller campaign provides valuable insights that can be leveraged to improve the full-scale launch.

StreetShares Successful Fundraising Using Regulation A+

StreetShares, a leading platform for small business financing, recently completed a successful investment campaign utilizing the Regulation A+ framework. This progressive method of securing funds allowed StreetShares to attract significant investor interest from both retail investors, highlighting the growing acceptance of Regulation A+ as a viable option for companies seeking non-traditional financing.

Regulation A+ Offerings | Reg A+ Rules | Regulation A+ Crowdfunding Crowdfunding

The JOBS Act has introduced a new avenue for companies to raise capital via Reg A+ offerings. This regulation provides a streamlined path for companies to go public, making it more accessible than traditional IPOs. Regulation A+, also known as "mini-IPO," allows companies to raise up to $75 million from both accredited and unaccredited investors through a public offering.

Reg A+ Issuers can utilize FundersClub to enable these raises on their platform. The SEC has approved new "Reg A+" rules for Fundraising, differentiating it from other methods like Regulation D, which primarily caters to accredited investors.

There are distinct differences between Reg A+ and Regulation D. Regulation D, particularly Rule 506(b) and 506(c), offers more flexibility for companies seeking to raise capital privately, but typically involves stricter eligibility requirements. Conversely, Reg A+ mandates greater Disclosure due to its public nature.

While Regulation A+ presents an attractive alternative to traditional IPOs, it's crucial for Issuers to understand the specific Rules associated with this offering type. Consulting with experts in securities law and financial Consultants is highly recommended.

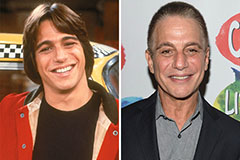

Tony Danza Then & Now!

Tony Danza Then & Now! Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! Joseph Mazzello Then & Now!

Joseph Mazzello Then & Now! Richard "Little Hercules" Sandrak Then & Now!

Richard "Little Hercules" Sandrak Then & Now! Judge Reinhold Then & Now!

Judge Reinhold Then & Now!